Comparing Anti-Manipulation Approaches in Bitcoin Futures Products

When trading on high leverage derivatives contracts, fairness in the market is absolutely essential. If you’re trading at 10x, 20x, or God forbid, 100x — as little as 1% move in the market can cause your account to be wiped out. That’s why having a robust trading system that is resistant to manipulation by large players is essential for futures and options trading platforms, especially in a volatile market like crypto.

The main tools that exchanges employ to develop manipulation-resistant systems are:

-

Fair value mark price to determine liquidations

-

Order / Position limits

-

Price limits

Some exchanges employ all of these, others employ only 1 or 2 of the above. But one thing remains true: all exchanges make some effort to run markets that can’t be manipulated.

I will focus on Bitcoin-Dollar futures products with time-expiration traded on the larger exchanges. Note that the same principles apply to alt-coin futures: just that they tend to be more strict as a function of underlying spot liquidity/market cap.

Mark Price

The mark price is essential for most bitcoin derivatives platforms. It’s the magic price that triggers liquidations. Its accuracy is critical to having a stable and fair risk management system.

For perpetual contracts it is quite straight forward: because settlement occurs very frequently and anchored by a funding rate payout, exchanges can set the Mark Price either to the spot Index Price or do some time-decay netting out the current funding rate from Index Price.

However, for fixed-maturity contracts, or time-based contracts, AKA traditional futures contracts, it becomes more of an art to establish a fair value mark price.

As discussed in prior articles, the value of a fixed-maturity contract can fluctuate with sentiment and the rates environment: in more bullish markets, traditional futures contracts will trade at higher premiums the further out in time they expire. In bearish markets, they will trade at relatively lower prices and maybe even at a discount to spot price.

This presents a challenge for futures exchanges that want to establish a fair mark price for their time-based contracts: how do you allow the market to discover a fair market premium/discount to index while avoiding an environment that is easily manipulated by large players?

Below is a comprehensive list of current Mark Price formulas by top futures exchanges:

OKex: Mark Price = Spot index price + moving average [(best buy + best sell) / 2 - spot index price]

BitMEX: Mark Price = Index Price + [Index Price (Impact Mid Price / Index Price - 1) / (Time To Expiry / 365)] (Time to Expiry / 365)]

where Impact Mid Price is the average of the fill prices 2.5 XBT deep on ask and bid side.

Deribit: Mark Price = index price + 30 seconds EMA of (Fair Price — Index Price).

Where Fair Price is the 1BTC deep average of bid and ask of the order book.

FTX: Mark Price = [median of last, best bid, best offer] if future is not paused, otherwise index price + last premium

Huobi, one of the largest exchanges, interestingly does not implement any mark price approach.

BTSE: Mark Price = BTSE Time-based Futures Index Price x 75% + [(Bid Price x Ask Size + Ask Price x Bid Size) / (Bid Size + Ask Size) x 25%]

where BTSE Time-based Futures Index Price = Spot Liquidity Mid Price x (1 + Fair Basis)

and

Fair Basis = Average Time-based Futures Premium (or Discount) Percentage of major exchanges.

BTSE is the only exchange that actually uses the rest of the market to derive a fair basis on the time-based contracts. Given that there is a rather large market now it is a robust approach to having a sensible mark price.

Note that the complexity of the formulas vary from exchange to exchange, the ones that are simpler tend to rely more on the other 2 anti-manipulation mechanisms of Price Limits and Order/Position Limits.

Order / Position Limits

Orders move the market, plain and simple. Controlling the size and aggressiveness of orders thus becomes an effective mechanism to maintain a market with integrity. It can also help in reduce spoofing activity which aims to influence the market price.

Most exchanges set both an order limit and a position limit. That is, they do either a simple or comprehensive limit in the size of an order that can be placed in the book or penetrate through the book. As for position limits, most exchanges require larger positions to pledge more collateral — meaning unwinding them is less risky to the overall system — and set an absolute maximum to avoid any one player dominating the open interest and being able to push price around.

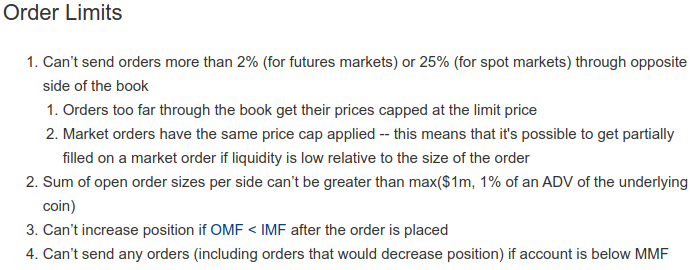

The most comprehensive approach in this area is probably FTX:

On the position side of things they set a $2.5 million position limit and assign higher “weighting” toward the position limit for lower-liquidity coins.

BitMEX sets an order SIZE limit of $10,000,000, as does Deribit (as well as max position size of same value).

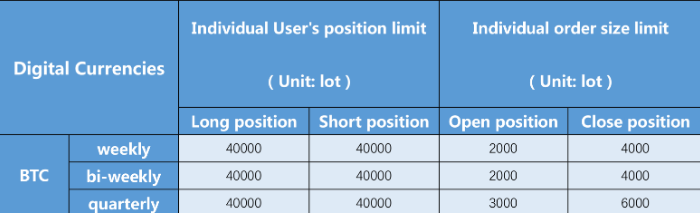

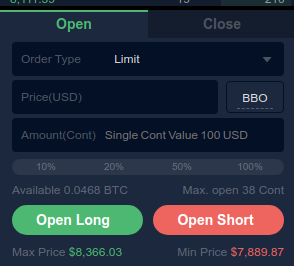

Huobi has $4,000,000 max position sizes in place ($100 contract value), with max order values of $200,000-$600,000:

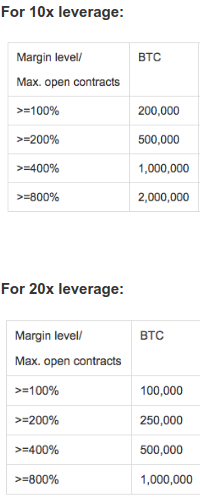

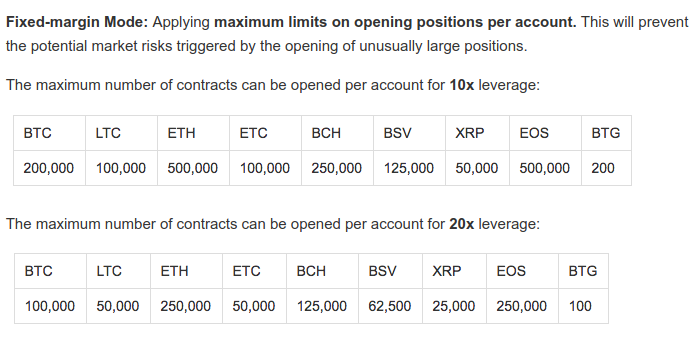

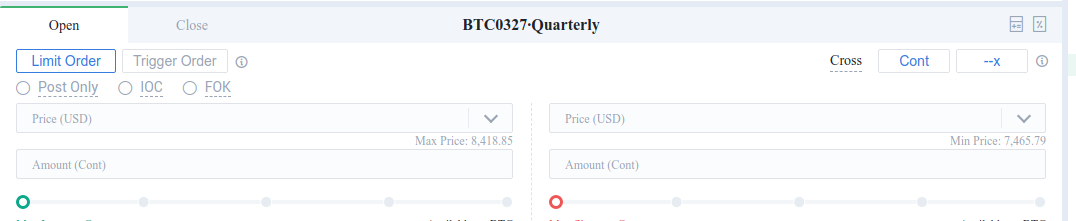

OKex, which had a major blowup on their futures market about 2 years ago, finally instituted position limits to avoid large traders pushing around the price (but they have no order limit). The position limit ranges from $10,000,000 to $200,000,000. Their model is split up between Cross-Margin mode (where your entire futures account is at risk) and Fixed-margin mode (where your positions are isolated at a given leverage setting):

BTSE has order limit of 50 BTC and position limit of 200 BTC.

Price Limits

Price limits or price bands are efforts to limit the executions in the market, or “last price”. It is the most blunt way to enforce that market prices are valid and fair.

The main fear is that people will use large orders to penetrate the books, or take advantage of thin orderbooks, to execute prices that are outside of the fair market range — thus running people’s stops or trying to push the mark price around. Generally these price limits take the form of setting a max deviation of market price over a set amount of time: 1, 5 minutes. It can also focus more on controlling the premium growth relative to the spot index, to avoid sudden rapid changes in basis.

This is the anti-manipulation method utilised by Huobi and OKex:

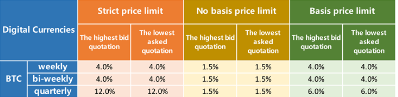

Huobi has three sets of price limits: strict price limit, non-basis price limit (to allow price discovery) and basis price limit:

This is just a hard-coded limit based on time to maturity which sets the permissible range for users to execute trades in the market. Any trades attempted outside of this range are simply rejected.

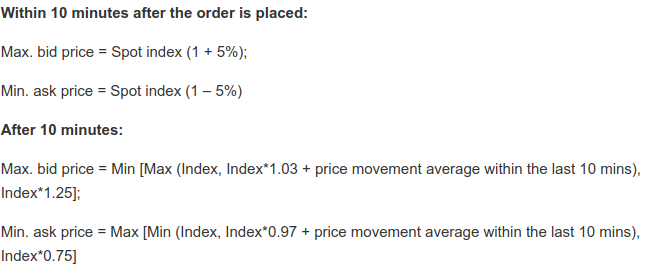

OKex takes a similar approach, splitting up the first 10 minute window and post-10 minute window of trading on a contract:

These numbers are derived from years of experience that the shops have running contracts and knowing the sane range of premium from the spot price.

Deribit uses a more simple formula of:

Deribit Index + 1 minute EMA (Fair Price - Index) +/- 1.5%

AND

Fixed bandwidth around the Deribit Index +/- 7.5%.

This means any orders attempting to breach the above lead to an adjustment to the price that is within the range defined.

BitMEX has no price limits documented.

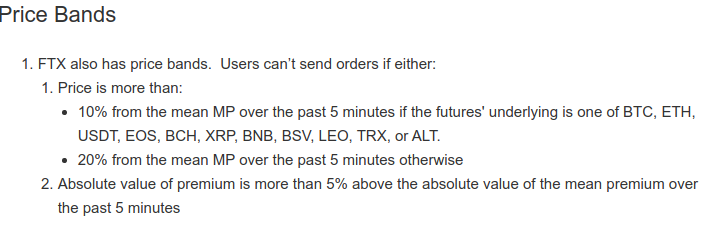

Finally, FTX has a price limit approach based on a strict deviation of 10% from past 5 minutes and average premium in past 5 minutes:

BTSE has fat-finger protection for large orders penetrating beyond 2% of the book but no explicit price brands preventing execution.

Conclusion

One of the biggest fears traders have is that the market they are trading on with moderate or high leverage is susceptible to be manipulated against their favour. Exchanges in the bitcoin futures space are keenly aware of this and have taken multiple steps to minimise the risk of manipiulation, primarily:

-

Marking position values for risk management purposes to a “fair value” mark price based on conditions external to the futures market

-

Setting order and position size limits to prevent large traders from pushing the last price in the market around

-

Setting price band limits that prevent executions outside of a reasonable fair market range

The above steps help give traders confidence that regardless of what is happening on a platform their open positions will be treated fairly and they won’t suffer liquidations due to “scam wicks” or other shenanigans on the market.

Concept/creator: swapman - Head developer: instabot

Instabot is also founder at Alertatron, an alerting and trading automation service.