Different Liquidation Models of Platforms in Bitcoin Futures

When trading high leverage bitcoin futures it is important to understand how platforms use different models to liquidate bankrupt traders.

If a user gets liquidated on a position, the exchange will assume the position of the trader and either partially or completely liquidate it into the market until the user is at 0 or positive equity.

In contrast to most legacy platforms, Bitcoin Futures platforms do not push traders into negative balance if they are liquidated at below their bankruptcy price. Instead, exchanges use often advanced techniques to cap the loss at the 0-balance level of a trader’s account and instead manage the risk using one (or more) of three strategies:

-

Socialising the loss against profitable traders at daily/weekly settlement

-

Utilising an insurance fund to aggress the price of liquidations to make them more attractive for other counterparties to take the other side

-

Assigning bankrupt positions to back-stop liquidity providers who sign up to take the risk

-

Termination / auto-deleveraging the position by cutting Open Interest

Most exchanges use a combination of the above to manage counterparty trading risk on their platforms.

Remember: Bitcoin Futures are a zero-sum game. Every long position has a corresponding short position and as volatility hits the market, it becomes a game between counterparties where the exchange has to balance out the longs to shorts and use various tools to maintain system harmony.

Anatomy of a Liquidation

To understand how liquidations work in the market let’s walk through an example using a BitMEX or Deribit style trade on inverse bitcoin futures.

As a starting point say the market price is $6,000 and a user is long 6,000,000 contracts ($6,000,000 or 1,000 BTC). BitMEX requires these positions to have initial margin of 5% and maintenance margin of 4.5%, or a 20x long position.

So this user then has 50 BTC down as margin and will get liquidated when his equity is at 45 BTC, or a loss of 5 BTC.

The PnL formula for BitMEX on a long is: N*[(1/Entry) — (1/Exit)]

Solving for liquidation exit price yields: -45=6,000,000/6,000–6,000,000/Exit

1,045 = 6,000,000/Exit

Liquidation Price=$5,741.62

The “bankruptcy price” for this position would be equal to the exit when the loss is -50 BTC, or the entire initial margin backing the position:

1,050=6,000,000/Exit

Bankruptcy Price = $5,714.28

For simplicity we ignore impact of fees and funding to focus on the core concepts.

Now, as soon as the Mark Price (discussed in some detail here) hits the liquidation price of $5,741.62 then the position will enter liquidation, where part or all of it is sold into the orderbook to get the trader into positive equity.

Finally, note that on inverse contracts margin is XBT and the loss the further away from entry price leads to a larger XBT loss.

The computations, therefore, are different for linear contracts (CME, FTX, BTSE) which have linear PNL and do not have to take into account for curvatures further away from entry. However, the general concepts described below remain the same regardless of using inverse or linear contracts.

Partial Liquidation

In a partial liquidation system, this 6,000,000 position would be only partially liquidated into the market until the size is reduced (and the corresponding maintenance margin lowered) enough to where the user is solvent again in terms of their Equity exceeding their Maintenance Margin Rate.

Using the above example let’s say the engine partially liquidates the user’s 6,000,000 position at 6,000, equal to 1,000 XBT at entry, down to 1,200,000 at 6,000 equal to 200 XBT at entry, which carries a 0.5% maintenance margin requirement of 1 XBT.

Cutting the position down to 1,200,000 means the user sold 4,800,000 contracts and has lost:

4,800,000*[(1/6000)-(1/5,741.62)]=-36 BTC

So user has now 50–36=14 XBT in equity.

For a 1,200,000 remaining position at 6,000 entry the user has to lose 13 XBT to breach the new MM requirement of 1 XBT:

-13=1,200,000/6,000–1,200,000/Exit

-213=1,200,000/Exit

New Liquidation Price=5,633.80

Thus, the partial liquidation of the position results in the user not being completely wiped out on the position but salvaging 1,200,000 out of 6,000,000 contracts and having a resulting lower risk limit and lower maintenance margin requirement which will stay open as long as price doesn’t continue to drop from $5,741 to the new liquidation price of $5,633.

The exchanges which have tiered margin systems that require higher margin for bigger positions tend to utilise partial liquidation model: BitMEX, Deribit, FTX.

Total Position Liquidation

Other exchanges, even ones that require higher margin for larger positions, will just liquidate the entire $6,000,000 contract isolated position or total account at risk if the user is in liquidation.

This means that even though the system could theoretically reduce the position and risk to a point where total liquidation is not necessary it will wipe the entire position — sometimes taking the maintenance margin as well. OKex and Huobi are the larger exchanges which do this and they will take the entire maintenance margin. Kraken Futures will liquidate the entire position and return whatever maintenance margin is left over in the market to the user.

Socialised Losses

Socialised losses was the mechanism that Bitcoin Futures 1.0 platforms used to manage risk, before perpetual swaps/futures were a thing. BitMEX obnoxiously called their social loss system “Dynamic Profit Equalisation”.

Coming back to the original liquidation example: once the $6,000,000 long was liquidated at $5,741, the system would take a gigantic sell wall in the orderbook of $6,000,000 at $5,714, the bankruptcy price of the user.

Keep in mind: Liquidation Price is the price at which liquidation is triggered. Whereas Bankruptcy Price is the price where the user has 0 equity remaining. The amount between the two represents the maintenance margin buffer to allow the system to liquidate before the user is bankrupt — with the difference between the filled price and the bankrupt price often going into an insurance fund or back to the user.

Then every Friday there would be a settlement in the market. Let’s say that only 1,000,000 contracts was filled of the 6,000,000 at $5,714, and the market price continued to drop until it was $5,000 on Friday. That means there is an overhang of 5,000,000 contracts entered at $6,000 that is now at a massive loss at $5,000 that needs to be filled.

At the bankruptcy price of the trader $5,714 the loss is:

5,000,000*[(1/6000)-(1/5714)]=-37.5 BTC

At the settlement market price of $5,000 the loss is:

5,000,000*[(1/6000)-(1/5000)]=-166.67 BTC

So this makes for a 129.165 BTC loss in total that needs to be recovered.

Now by definition of the parimutual bilateral contract system of futures, this loss has to be at least equal or less than the gains in the system of users who were short.

Thus, in a socialised loss system you take the 129.165 BTC hole in the system and spread it around to all the winning traders, pro rata, and reduce the 5,000,000 sell wall price from $5,714 to $5,000 if the market has not closed or you settle the open interest, closing it out, at $5,000.

How Does an Insurance Fund Work?

With an insurance fund model the exchange decides to have a reserve of assets which can be used to “aggress the order price” of unfilled liquidations such that the liquidation may be filled by another counterparty in the orderbook.

Using the above example again, the 6,000,000 contract position is liquidated at $5,741 with a $5,714 bankruptcy price. Beyond the $5,714 bankruptcy price, the system begins to take a loss that has to be covered in one way or another.

In the socialised loss example, the system waited until weekly settlement and then taxes winning traders to make up the hole.

With an insurance fund model, there are funds set aside, usually with additional fees on liquidations over time, which can be used to help mollify the damage of unfilled liquidations.

In most systems now, like BitMEX, Deribit, FTX — there is an algorithm which measures the risk in market and will strategically spend some of the insurance fund money to make an unfilled liquidation order more attractive vs. mark price so other traders will be incentivised to scoop it up.

So let’s say mark price hits $5,700 on the above liquidation which has a bankruptcy price of 5,714. A liquidation algorithm might decide, okay, in order to fill this 6,000,000 contract long that is bankrupt at $5,714, let’s set the order price to $5,690 to attract buyers who see an opportunity versus the $5,700 mark price.

In order to fund this “order aggression”, we need to compute:

5,000,000*[(1/6000)-(1/5714)]=-37.5 BTC

This is the bankruptcy price where the bankrupt trader’s equity covers the hole.

At the aggressed order:

5,000,000*[(1/6000)-(1/5690)]=-45.4013 BTC

To fund the loss beyond the bankruptcy price the liquidation engine must spend -45.4013+37.5=-7.9 BTC in order to make the order price of the unfilled liquidation more attractive and get new traders to buy into it.

This mechanism of using an insurance fund to avoid more drastic measures such as socialised losses or auto-deleveraging, is a clean way to provide “insurance” in the market against high volatility that may lead to more unfilled liquidations.

Most exchanges have insurance funds to support the market in one way or another, with BitMEX having the largest one, followed by Huobi and OKex and FTX and Binance.

Auto-Deleveraging: Socialised Losses by a Different Name

Auto-deleveraging sounds real fancy and sophisticated. But in practice it is just socialised losses by a different name.

If orderbook liquidations and insurance fund spending to improve unfilled liquidation orders doesn’t work, many exchanges will resort to breaking off the open interest between the liquidated user and some opposing position, usually one that is larger and more levered (in profit).

Going back to the example above, with 6,000,000 contracts bankrupt at 5,714: if the liquidation goes unfilled and the liquidation engine feels that it is not worth to spend any insurance fund money, then it will find someone or multiple traders that have 6,000,000 short position to “break-off” the open interest and equalise the system.

Remember, this liquidated trader is LONG and bankrupt, and to equalise the system we need to find SHORT traders to the tune of 6,000,000 contracts and kick them out of position to make the system whole.

Most ADL/OI termination systems will use some kind of logic to pick users who would be least-harmed by being kicked out of position. In this case, we would try to find 6,000,000 contracts short that are highly levered (usually very profitable and large traders) that would be in profit and kicked out at a price of $5,714 — making the bankrupt trader not lose any money, and making the zero-sum system equal again.

Basically every exchange now uses this approach: BitMEX, Deribit, Kraken Futures, OKex, Huobi, FTX, Binance.

Position Assignment to Back-stop Liquidity Providers

The final method used to handle unfilled liquidations is a method pioneered at Kraken Futures called **position assignment system**.

The idea behind this is that once a liquidation is pushed through the books, if there is any remaining then there is a list of marketmakers who sign up as “back-stop liquidity providers” (to use FTX’s term for the approach) who will assume the position at the bankruptcy price. Why do marketmakers elect to participate in such a scheme? It’s quite simple, these liquidity providers assuming the position at bankruptcy price means they immediately profit from the difference between the Liquidation Price and the Bankruptcy price of the liquidated user.

The idea behind this system is that a skilled marketmaker can almost immediately offload the position in another futures or spot exchange that is quoting closer to liquidation price (Mark Price) than the Bankruptcy Price. Thus, it presents a profitable proposition to marketmakers who are willing to take the risk that they can offload the position before the market price continues to run against them (which is a real risk they take).

The only exchanges with a public program of this nature are Kraken Futures and FTX.

Which Approaches do Top Exchanges Use?

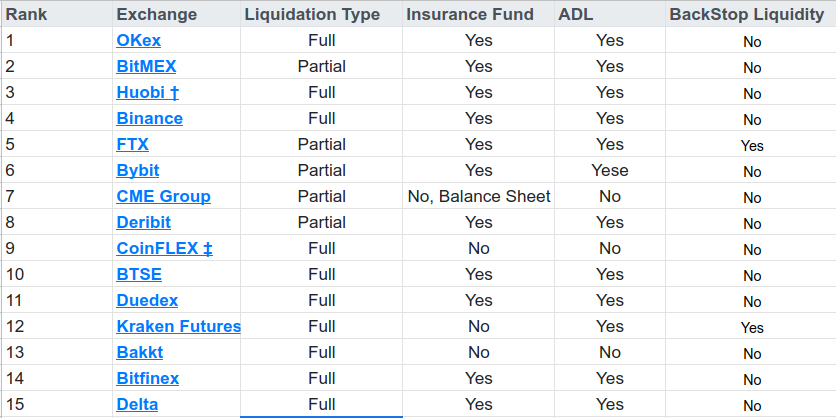

As of March 15, 2020 the top 15 exchanges’ liquidation models are provided below:

Source: Author

Source: Author

This shows how the current market varies in their approaches based on the dimensions of Liquidation Type (partial or full), Insurance Fund existence, ADL usage, and Backstop Liquidity Provision system.

Conclusion

Exchanges in the bitcoin futures market utilise a variety of risk models to handle liquidations under volatile market conditions. This varies from exchange to exchange but the most popular model is a combination of:

-

Partial liquidation to avoid large orders crashing into the books

-

Insurance fund to aggress unfilled liquidations to be filled by willing counterparties

-

ADL to force counterparties on other end out of position and reducing OI

The market has come a long way in 2020 since the days of 2015 where OKex and BitVC (Huobi) dominated the market with socialised losses and BitMEX copied the model using “Dynamic Profit Equalisation”.

Now, the insurance model + ADL seems to dominate and there are newer innovations from Kraken Futures and FTX on sourcing liquidity from sophisticated participants to take on bankrupt positions.

Concept/creator: swapman - Head developer: instabot

Instabot is also founder at Alertatron, an alerting and trading automation service.