Fee Structures on Bitcoin Futures Platforms

Note: the data in this article is valid as of the date of publication: 1. March 2020

Fee levels on bitcoin futures can be confusing for many traders. There are often multiple dimensions at play. There typically is not merely a fixed fee charged. Instead, there is usually other factors that change the fee charged based on the context of the account trading, such as:

-

There is usually a lower fee charged for passive “maker” limit orders which get filled by another trader, and higher fees charged for active aggressor/”taker” orders where the account is filling a passive order.

-

There is often volume-based discounts applied for highly active traders who pay lower maker and taker fees if they have traded above a certain level.

-

Some exchanges charge higher fees for using higher leverage in their positions.

-

Many exchanges have “Designated Market Maker” programs which offer benefits for providing consistent liquidity and/or hitting volume targets

-

Many exchanges have exchange-tokens issued by the platform to induce incentives, where benefits are valid if user is holding the token in their account.

-

While some exchanges have public VIP / marketmaker programs, others keep it behind the scenes, but just about all of them have some sort of “whale” benefits. This article will only go over the public programs as I am not at liberty to disclose any private incentives, if there are any.

Note that every trade constitutes both a maker and taker side — so the exchange earns money on the combination of maker and taker fee for every volume traded.

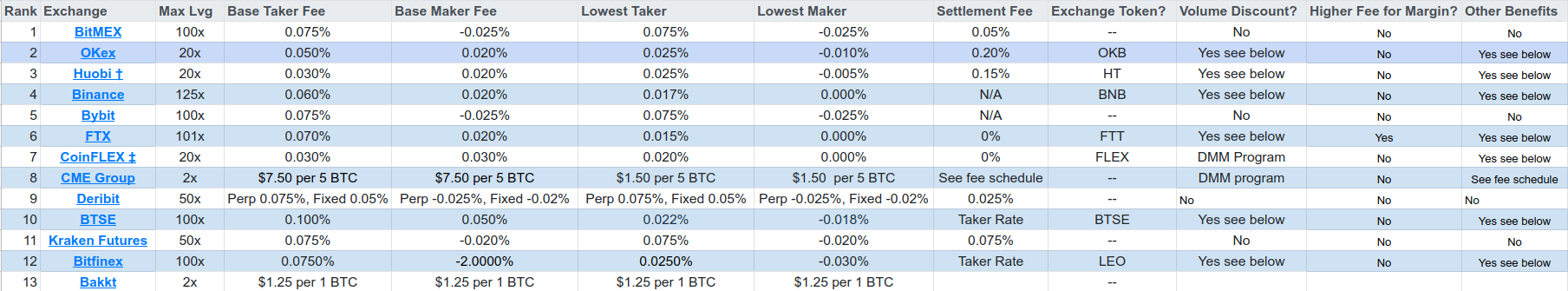

Overview of exchange fee structure and incentives

Overview of exchange fee structure and incentives

BitMEX

The BitMEX fee structure can be found here: https://www.bitmex.com/app/fees

BitMEX also has a referral program where the referrer gets lifetime benefits (10–15%) and the referee gets 30-days 10% trading fee discounts.

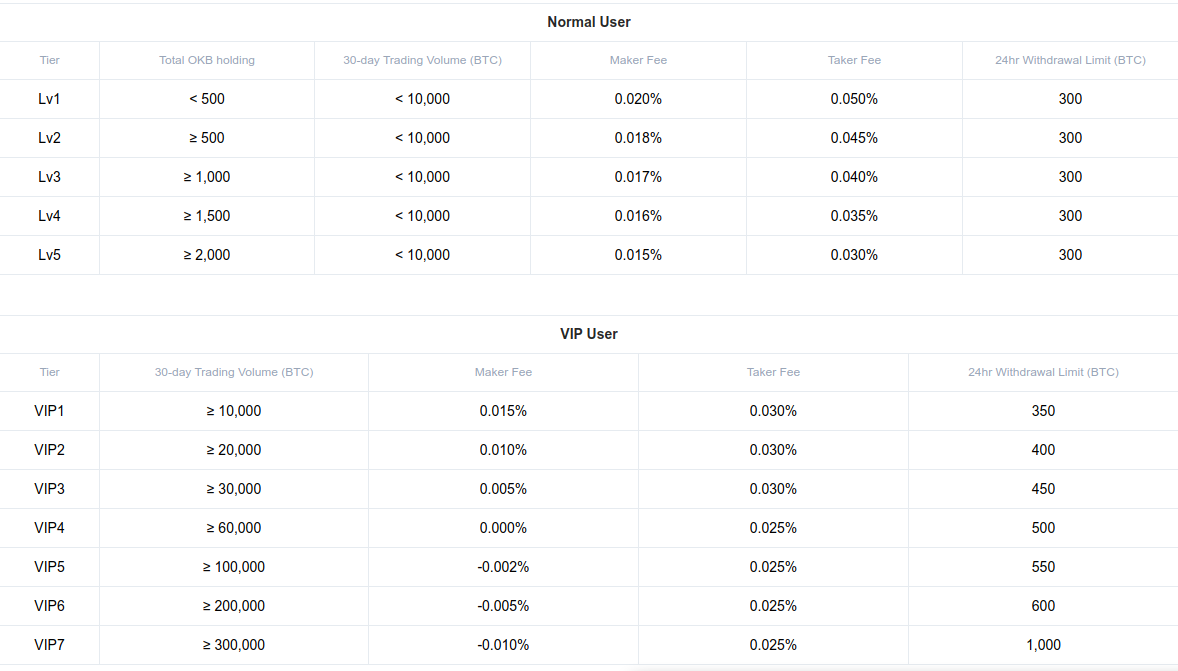

OKex

The OKex fee structure can be found here: https://www.okex.com/en/fees.html

The fees vary based on whether the user is in the “VIP” program, and by the volume of trading in the past 30 days and/or the OKB exchange token holdings in the account.

Futures:

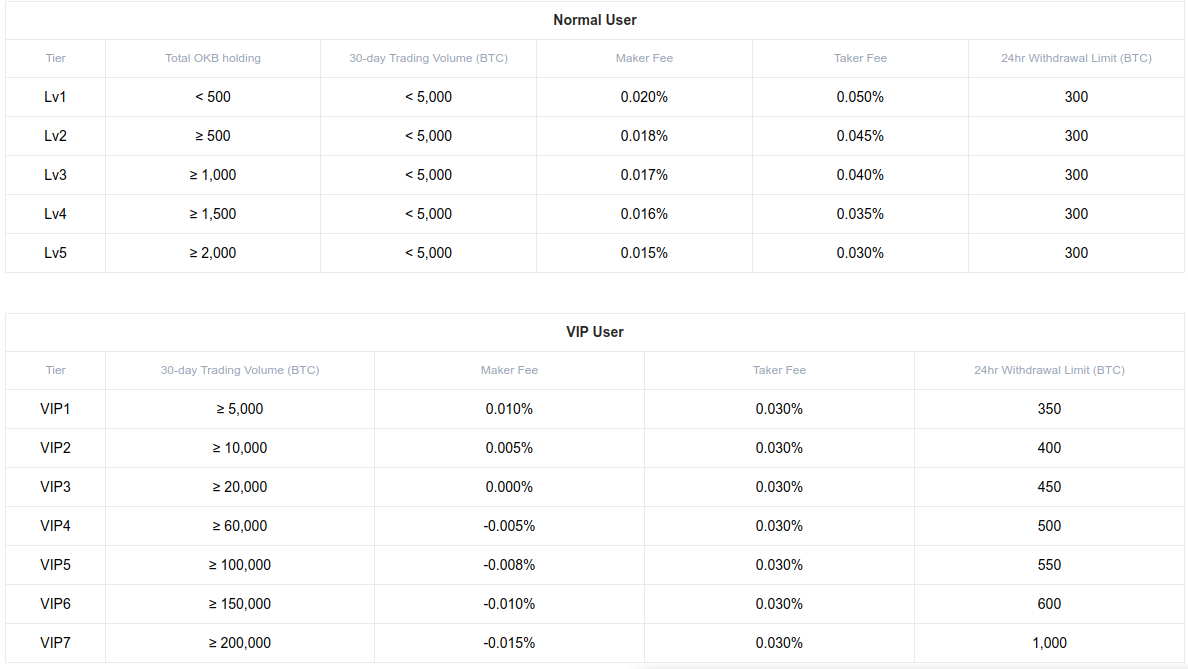

Swaps:

OKex also has a modest referral program with some relatively strict requirements for the user being referred having minimum trading volumes and being fully verified, more details here: https://okexsupport.zendesk.com/hc/en-us/articles/360034107232-OKEx-Launches-Referral-Program-

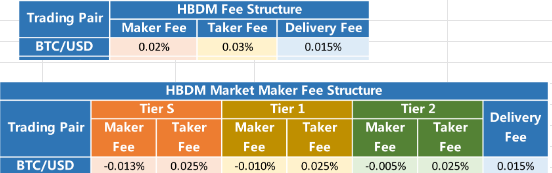

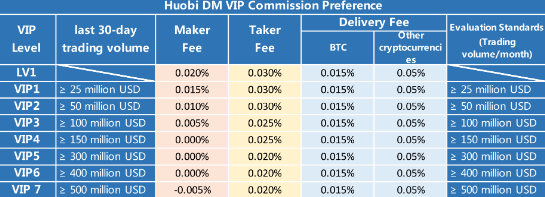

HuobiDM

The fee structure can be found here: https://huobiglobal.zendesk.com/hc/en-us/articles/360000113122

Huobi, like OKex, has a VIP program and exchange token (HT) where they incentive volume and token holdings and the fee varies by these factors:

Huobi also has an “invite program” where you can earn 30% of the fees generated for the first 3 months of your referees: https://www.huobi.com/en-us/invite/

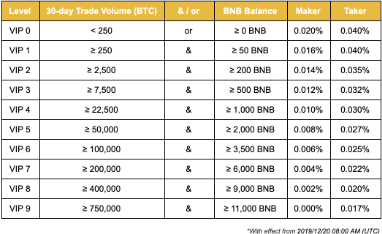

Binance

Binance has the most valuable exchange token in the space: BNB, and a fee structure that varies based on volume: https://www.binance.com/en/support/articles/360033544231

Binance also has a referral program where you can earn 20–40% of trading fees of referees based on BNB holdings: https://www.binance.com/en/activity/referral

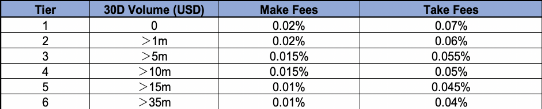

ByBit

ByBit has no exchange token or other incentives, their fee structure is similar to BitMEX’s: https://help.bybit.com/hc/en-us/articles/360009712294-What-are-the-trading-fees-like-on-Bybit-

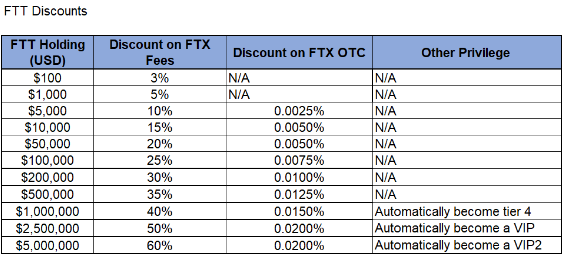

FTX

FTX has an exchange token FTT which has a buy and burn of 30% of revenue and fee incentives for holding certain USD amounts of the token. They also provide discounts for volume and have a marketmaking program: https://help.ftx.com/hc/en-us/articles/360024479432-Fees VIP program FTX has a VIP fee program for high volume traders. If you are a professional trader or trading firm that uses other…help.ftx.com

CoinFLEX

CoinFLEX has an exchange token FLEX which provides fee discounts, particularly on taker-trading through its trade-mining program: https://coinflex.com/fees/ FLEXMaker Program - CoinFLEX The NEW FLEXMaker Program (Last edited on 30th January, 2020) As part of our new set of offerings to our various…coinflex.com

CME Group

CME, as a listed and regulated exchange, has a different type of fee structure than original crypto exchanges. It charges the same for buy/sell, maker/taker, and the fees vary based primarily on the type of trader: https://www.cmegroup.com/company/files/cme-fee-schedule-2020-02-01.pdf

Deribit

Deribit has no volume incentives or exchange token — they have an aggressive maker rebate and a slightly different fee structure for fixed-maturity versus perpetual. See fee structure details here: https://www.deribit.com/pages/information/fees

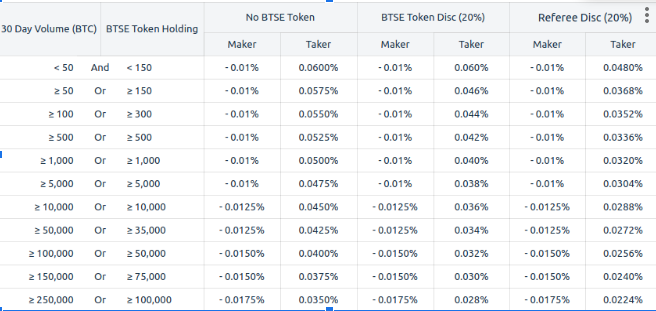

BTSE

BTSE has a Liquid-based exchange token where the fees vary based on holdings of the token, exchange volume, or market-maker status: https://support.btse.com/en/support/solutions/articles/43000064283-what-are-the-btse-trading-fees-

Kraken Futures

Kraken Futures has a flat 0.075% and -0.02% taker/maker fee model. There is no volume discount or exchange token benefits: https://support.kraken.com/hc/en-us/articles/360022835771-Transaction-fees-and-rebates-for-Kraken-Futures

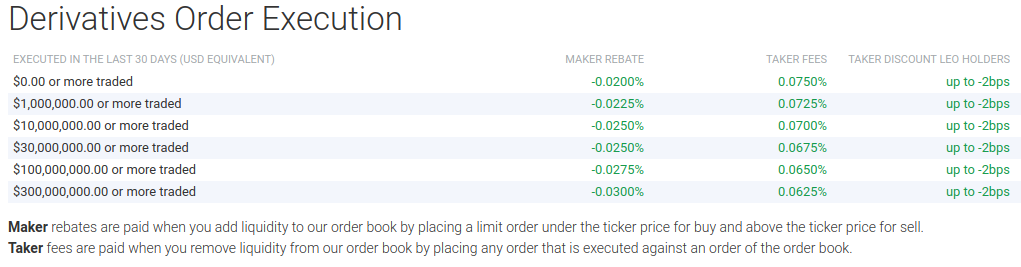

Bitfinex Futures

Bitfinex has both an exchange token, LEO, and volume discounts for their trading fees on derivatives: https://www.bitfinex.com/fees

Bakkt Futures

Bakkt is one of the worst performing exchanges in the space and, like CME, charges a flat dollar rate on contracts sold: $1.25 per 1 BTC. More can be found on their latest trading brochure: https://www.bakkt.com/publicdocs/Bakkt_Bitcoin_USD_Cash_Settled_Monthly_Futures_Overview.pdf

Summary

The trend in derivatives exchanges is to offer a loyalty-style exchange-token where fees are reduced if the account is holding more of the token. Additionally, most exchanges provide a volume-based discount so the more trading activity being done the lower the fees. Some exchanges offer a VIP or Marketmaking program that attaches additional benefitts beyond holding an exchange token or giving volume discounts.

Since liquidity is so important on high leverage futures exchanges, many provide maker REBATES where the trader gets paid for providing passive liquidity and getting filled on the market. This is made up by a higher taker fee so that the exchange ensures they are making a net profit off any trading activity.

Concept/creator: swapman - Head developer: instabot

Instabot is also founder at Alertatron, an alerting and trading automation service.