Trading Strategies for Bitcoin Futures Premiums

Bitcoin-Dollar futures markets have grown enormously over the past years.

The first time I wrote about how to profit from the premium structure on bitcoin futures products was in 2015 when there were only a few players on the scene: OKCoin, BitMEX, and Huobi. Now there are over a dozen players doing a combined >$10Billion a day in notional trading volume.

The opportunities are now better than ever with more liquidity, more product variety, and more arbitrage money on the table.

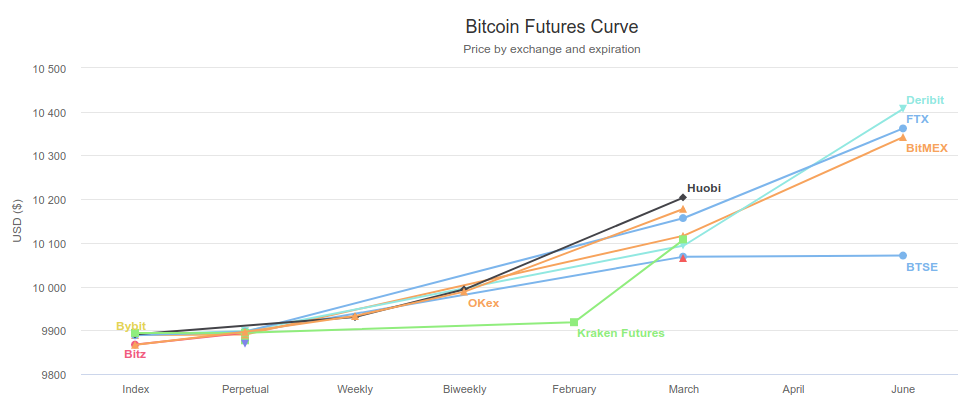

I want this to be as practical as possible so I will try to avoid going into financial theory too much, but as a starting point, futures tend to trade at a premium to spot price. This is thanks to covered interest parity which governs the relationship between bitcoin and USD and the future value of each based on the borrow/lend rates of each asset. Although speculation is mostly what drives the premiums in bitcoin. This is why the Bitcoin-Dollar futures curve is usually in a state of contango, i.e., rising prices with respect to time in the future:

Take a good look at this graph. Notice that there are some differences between exchanges at the various expiries. Notice the premiums further out in time. This is referred to as the “basis” in bitcoin, and it can be profitable to arbitrage.

In this article I will focus on three main strategies to gain relatively low-risk fiat-based yield using your bitcoin in the futures markets:

- Classic cash-and-carry futures arbitrage

- Inter-exchange premium arbitrage

- Funding rate perpetual contract synthetic USD yield

The key difference between fixed-maturity futures and the perpetual contracts is that the fixed-maturity futures have a fixed premium that you pay when you open your position at time t to time at expiry x. In the perpetual contract you pay a fluctuating rate that adjusts usually every 8 hours between time t and time x. This means that if you want to take a position on BTC/USD for 30 days, you can know exactly how high of a premium you take in a monthly contract or take the same position on a perpetual contract and hold it for 30 days and pay an uncertain rate going forward.

Usually in bullish markets the premium will tend to be higher as bulls are competing to get in position for upward price movements. In bearish markets the converse is true: contracts tend to trade at a lower premium and may even trade at a discount to spot price as people rush to preserve capital in a down market.

Most monthly/quarterly fixed maturity contracts expire on the last Friday of said month and some contracts require BTC only as collateral (and have inverse payout structure) while others allow only USDT (and have linear structure) or allow both and payout in USD.

Cash and Carry Premium Arbitrage

Let’s go through a simple example of how, with fiat, you would earn a low-risk high-yield USD-based return using bitcoin and the vast futures market. I will use roughly the current information from the market above.

Date: February 23, 2020

Current spot market price for BTC/USD: $9,900

Futures contracts expiring March 27, 2020: $10,110

Days to maturity: 31

Let’s say you have $100,000 and you are tired of making a measly 0.15% per month maximum with American banks. Instead, you want to make some real USD yield using bitcoin. So you start by buying: $100,000/9,900 = 10.101 BTC.

You go to FTX, OKex, Deribit, BitMEX, etc. and short the March 27, 2020 BTC:USD futures - all of them accept BTC collateral and have dollarized-payout - 10.101 BTC worth or $102,121 worth for the inverse contracts with USD face value, at a price of $10,110.

You have now locked in a $210 premium for the bitcoin you purchased. This is a 2.12% return for only 1 month.

This is more than 10x the amount you'd get in the bank. Note that you are holding BTC in collateral for the hedge

leg of the trade, so even if the price jumps to $13,000 or more, you will still have captured the 2.12% USD yield.

Your PNL on the trade would be -102,121 * ((1/10110) - (1/13000)) = -2.2455 BTC, which leaves you with

10.101 – 2.2455 = 7.8555 BTC which at $13,000 is worth $102,121.5 - a profit of $2,121 in USD terms.

Now, I want to present this as realistically as possible so let’s go through the steps of the arb and the costs along the way. After all, this 2.22% return comes with a price, namely (estimates using FTX, will vary whether using maker/taker and inverse or linear futures):

- Cost to transfer USD into exchange: $30 (0.03%)

- Cost to spot-buy BTC (0.07%)

- Cost to futures-sell BTC:USD (0.02%)

- Cost to cover futures position on BTC:USD (0.02%)

- Cost to spot-sell BTC to USD (0.07%)

- Cost to transfer USD back to bank account: $30 (0.03%)

Total costs: 0.24%

Net return: 2.12% - 0.24% = 1.88% per month

Inter-exchange Premium Arbitrage

The next interesting arbitrage strategy is trading the dislocation of one exchange’s premium versus another.

See the chart below on the MARCH expiry and note that BTSE is an outlier:

Compared with FTX/BitMEX/OKex/Deribit/Huobi trading at $9,950, BTSE is trading at about $9,750. That’s a $200 difference. Extracting this difference in basis is quite easy:

Date: February 2, 2020

Spot price for today: $9,690

March 27, 2020 Futures on OKex: $9,950

March 27, 2020 Futures on BTSE: $9,750

Days to Maturity: 51

Let's use the same starting point as the other example and assume you have $100,000. You buy 10.32 BTC and send half to BTSE and half to OKex. Now you buy 5.16 BTC of BTSE March futures and sell $51,342 worth of inverse contracts at $9,950 on OKex. While the prices are different now, come March 27, they will both settle at the same price, which means you have captured the price difference by taking the two legs on the trade.

The basis opportunity there is $200 per coin, which is 5.16 * 200 = $1,032, or a return of 1.03% on your $100K put in.

Additionally, the opportunity is almost twice as long as the cash and carry one, so in a direct comparison it’s

about 0.64% for the month.

We assume total cost is similar to the cash-n-carry for 0.24%

Net return: 0.64%-0.24% = 0.40% per month

Perpetual Synthetic USD Funding Rate Yield

This is probably the simplest approach to getting yield in futures/swaps markets.

Similar to the cash and carry trade the idea is to capitalise on the premium. For perpetual contracts this manifests as a positive funding rate, where every 8 hours all long positions pay a rate to short positions (and in the market there is a 1:1 ratio of longs to shorts).

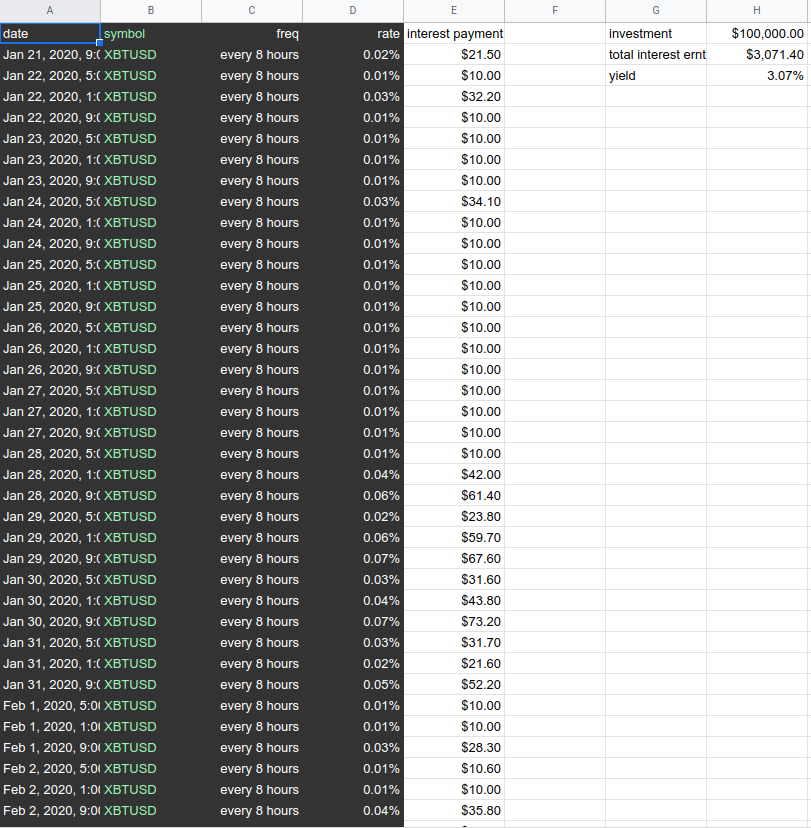

So we start with $100,000 again and assume spot is $9,900. You buy 10.101 BTC and send it to BitMEX and short $100,000 worth of the XBTUSD perpetual contract. Using the past month worth of funding rate data below:

This shows that there would be a total 3.07% yield in USD terms (but using BTC collateral and getting BTC payments). This is the highest of the three strategies reviewed in this article and the most simple.

Just like in the cash and carry you are holding BTC in collateral and have hedged the price risk by shorting at the same price the entire load for $100,000. So no matter what the swap price does you are just collecting funding interest payments and holding synthetic USD. The one risk to be aware of is that if the market shifts to bearish sentiment then the funding rates could go negative, meaning you will be paying interest rates. However, historically, the rates are consistently positive and should provide a good yield for you in USD terms.

Note also that the interest payments are in BTC, so if you want to maintain a delta-neutral position you should increase the hedge by the USD value of the incoming interest payments, so that you are not exposed to price risk going up. For example, you get a $10 interest payment of 0.01 BTC, then you increase your hedge to $100,010. This can be tedious but you can automate it if it is of concern to you - or you can hold the interest in BTC if you have an upward bias.

- 0.03% — $30 USD wire to Bitfinex or FTX

- 0.07% spot buy of BTC

- 0.002% btc xfer to BitMEX

- 0.075% taker BitMEX to open

- 0.075% taker BitMEX to close

- 0.002% btc xfer from BitMEX

- 0.07% spot sell of BTC to USD

- 0.03% wire back to bank account

Total cost: 0.35%

Net return: 3.07% — 0.35% = 2.72% per month

Summary

This article has gone through realistic scenarios of executing three arbitrage strategies where you can use BTC to earn low-risk yield in USD terms. In a time where rates are insanely low on bank deposits and bonds, these sorts of opportunities provide a novel way to get a good return on your fiat by using crypto financial tools.

The annual returns of the three strategies are:

Cash and carry: 26.66%

Inter-exchange arb: 4.8%

Perpetual synthetic USD yield: 32.64%

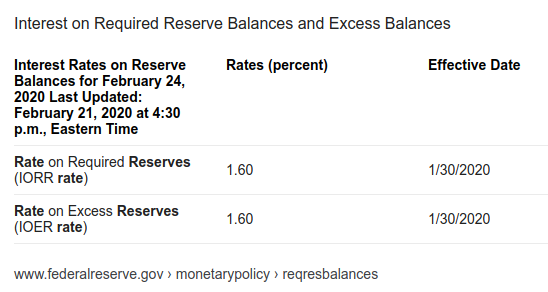

When you compare this to current yields on USD bank deposits:

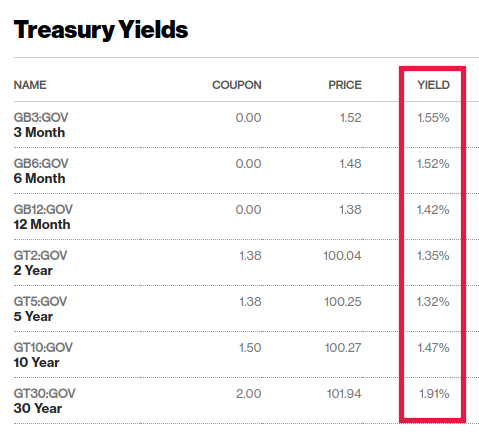

Or Treasury bonds:

You will end up earning about 1.5% in the normal rates market, and using any of the strategies explained here you will earn 4x to 22x more.

Risks

The only risks that you need to consider are that the exchange you trade the Futures on may get hacked or experience other issues where your funds are at risk (custodial risk). Or there may be socialised losses or Auto-Deleveraging due to large moves in the market (counterparty risk). These are relatively small risks if you trade with one of the larger reputable firms with insurance funds backing the integrity of the market.

Disclaimer

This is not financial advice. It is merely educational material about how futures contracts in the Bitcoin-Dollar market tend to behave and possible strategies that could be executed and have worked for some people before.

Concept/creator: swapman - Head developer: instabot

Instabot is also founder at Alertatron, an alerting and trading automation service.